Banking & Payment Systems | IGCSE ICT

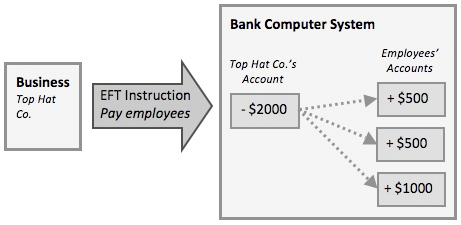

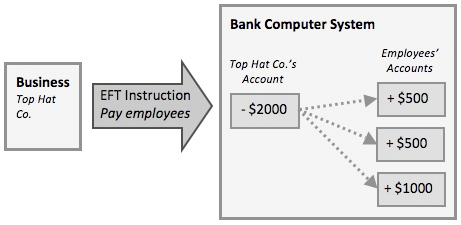

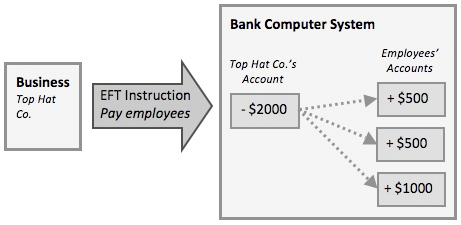

EFT is a system that allows money transfer instructions to be sent directly to a bank’s computer system. Upon receiving one of these instructions, the computer system automatically transfers the specified amount from one account to another.

Transfer instructions can come from other banks or from businesses.

A very common use of EFT is when a large business pays its employees’ salaries. On pay day, the businesses tells the bank to move money from the business account to the employees’ bank accounts.

Other examples of where EFT is used are discussed in some of the following sections.

If money is transferred from one bank account to another, nothing is physically moved - no piles of cash are picked up and moved from one place to another.

The amount of money in a bank account is simply a number in the bank’s computer system.

When money is transferred between accounts, all that happens is one number in the system gets bigger and another gets smaller.

Obviously the EFT system has to be very secure - the bank can’t allow just anyone to sent transfer instructions (otherwise we would all be sending messages to bank computers to move money into our accounts!)

The EFT system uses very strong encryption for all messages and the encryption keys are only given to trusted partners (other banks and big businesses).

Using Cash Machines (ATMs)

- Withdrawing cash

- Depositing money

- Checking the balance of accounts

- Transferring money between accounts

- Paying bills

ATMs can be used by customers of other banks as the ATM can use EFT.

- Bank B gives her the cash

- Bank B now is owed money by Bank A

- Bank B sends an EFT instruction to Bank A asking for money to be transferred from the customer’s account to Bank B.

- Bank B has now been paid back

Electronic Payments for Goods (EFTPOS)

Banks allow goods to be paid for electronically, using a system called Electronic Fund Transfer at Point-of-Sale (EFTPOS).

A full description of EFTPOS can be found here.

Internet Banking

It is now very common for bank customers to access their bank account from home using on-line banking services.

Customers use a computer and connect to the bank’s secure (encrypted) website where they login (usually with a username and a password)

- Check the balance of bank accounts

- Pay bills

- Transfer money between accounts (using EFT)

- Apply for loans, or other services

- More convenient - can be used 24 hours a day, 7 days a week

- Saves time and money since you don't have to travel anywhere to use it

- Data can be downloaded and analysed (e.g. in a spreadsheet) which can help with planning budgets

- Requires you to have a computer and Internet access to use it

- Some people prefer to speak to a person (personal service)

- If your account is hacked, or your username / password is stolen (e.g. if your computer has malware) money could be stolen from your account

Telephone Banking

This is similar to Internet banking, but does not require a computer, only a normal telephone.

- You enter your account number (using the phone's number keys)

- You enter your PIN / secret code

- You then hear various options: ("Press 1 to find your balance, Press 2 to transfer money. ")

- You pick an option (using the phone's number keys)

- And so on.

- Check the balance of bank accounts

- Pay bills

- Transfer money between accounts (using EFT)

- Speak to a bank representative to get financial advice

- You don't need a computer

- You can speak to an actual person

- The system can be difficult to use (working through all of those menus)

Processing Cheques (Cheque 'Clearing')

Banks have to deal with thousands of hand-written, paper cheques every day.

When a cheque arrives at a bank, the information on the cheque has to be entered into the bank’s computer system so that the correct funds can be transferred between the correct accounts. Entering this data quickly and accurately is a time-consuming and difficult task.

To help speed things up, a special system of printing is used on cheques that can be read by a reader connected to the computer system. At the bottom of every cheque, printed in a special font using magnetic ink, is the bank account number and cheque number:

Each cheque is passed through an MICR reader that can read these special numbers. (A small reader is shown here, but in large banks the MICR readers are much bigger and can thousands hundreds of cheques.

The hand-written part of the cheque (the payee and the value of payment) can be entered into the computer system by either using a human to read the writing and typing the data in, or by using OCR.

In the large cheque-clearing machine shown to the left, you can see the keyboard and screen that is used by the human operator to input the hand-written information on the checks.

(The rest of the machine contains cheque stacking and sorting mechanisms, and the MICR reader)

Sorry to ask you this, but.

This site took quite a bit of time and effort to create, and it costs me money to keep it up and running. If the site has helped you, please consider showing your appreciation by donating a little towards the site's running costs.

Thank you!

Sponsored Links.

You are here

- → Home

- → Theory Notes

- → 7.2 ICT Use in the Workplace

- → Banking & Payment Systems

Menu

- Home

- Read Me First!

- Theory Notes

- List of Topics

- Some General Concepts

- What is ICT?

- Data and Information

- What is a System?

- What is a Computer?

- Bits and Bytes

- 1. Types and Components of Computers

- Hardware and Software

- Main Computer Components

- What is an Operating System?

- User Interfaces

- Types of Computer

- 2. Input and Output Devices

- Input - Keyboards

- Input - Pointing Devices

- Input - Audio / Visual Devices

- Input - Card Readers

- Input - Reading Text / Codes

- Input - Sensors

- Input - Remote Control

- Output - Audio / Visual

- Output - Printing / Plotting

- Output - Control Actuators

- 3. Storage Devices and Media

- What is Data Storage?

- Backing Storage vs Main Memory

- Storage Media & Devices

- Accessing Stored Data

- Data Storage Capacity

- Data Access Speeds

- Magnetic Storage Devices / Media

- Optical Storage Devices / Media

- Solid-State Storage Devices

- Backing Up Data

- 4. Computer Networks

- What is a Network?

- Why Use Networks?

- Why Not Use Networks?

- Computers in a Network

- Types of Network

- LAN Topologies

- Networking Hardware

- The Internet

- Intranets

- Setting Up a Small Network

- Network & Data Security

- 5. Data Type and Organisation

- Different Data Types

- Data Organisation

- Types of Database

- Analogue and Digital Data

- 6. The Effects of Using ICT

- Social Effects of ICT

- Health Effects of ICT

- Safety Issues with ICT

- Hacking and Hackers

- Malware and Viruses

- Software Copyright

- Internet Developments

- Internet Use Issues

- 7.1 ICT Use in Everyday Life

- Communicating Ideas

- Handling Data

- Measuring Things

- Controlling Things On the Screen

- Controlling Real-World Things

- Modelling Things

- 7.2 ICT Use in the Workplace

- Modes of Computer Use

- Preventing Data Misuse

- Communication Systems

- Publicity & Corporate Image

- Expert Systems

- Manufacturing Products

- Booking Systems

- Banking & Payment Systems

- Payroll Processing

- Retail (Selling) Systems

- Stock Control Systems

- Medical & Hospital Systems

- School Management Systems

- Library Systems

- 8 Systems Analysis & Design

- What is Systems Analysis?

- Researching the Present System

- Analysing the Present System

- Designing a New System

- Testing the New System

- Documenting the New System

- Implementing the New System

- Evaluating the New System

- Practical Advice

- Communication (E-Mail & Web)

- Sending E-Mail

- Searching a Website

- Downloading Files

- Document Production (Word-Processing)

- Data Manipulation (Databases)

- Integration (Combining Stuff)

- Output Data (Printing & Exporting)

- Data Analysis (Spreadsheets)

- Website Authoring

- Presentation Authoring (Slideshows)

- CIE Syllabus

- CIE Past Papers

- Site Search

- ICT Links

- Site News

- Contact Me

![]()